Are you looking to buy or lease a car, but you’re worried about paying too much or walking away with the wrong car?

Jump To Section

Unfortunately, this happens to all too many people. One study even found that a whopping 70% of customers report buyer’s remorse shortly after signing on to a car deal. The most common complaints are feeling ripped off by salespeople, getting talked into a car with too many or too few features, or buying a car on impulse.

The power is in your hands to avoid these pitfalls. Check out these 8 common mistakes that car buyers make, and learn how to avoid them.

1. Looking for the wrong car.

There’s a car for everyone, but not every car is for everyone.

Revved-up sports car for a family of five? Not great.

Massive SUV for a single person just going around town? Also not so great.

Many people end up frustrated with car shopping or unhappy with the car they buy simply because they don’t look for the car that’s actually right for them.

Before you even start searching for a new vehicle, consider your needs as a driver. Be honest with yourself. You might itch for something fast, flashy or powerful over any terrain, but do you really need it?

A car is a big investment and a big part of your life. Choose practicality over trendiness.

2. Getting attached to a model.

Another common mistake is to fall in love with a specific model at the dealership. Many customers get attached to a car and decide that they simply must have it, even if it’s not ideal for them.

When people get starry-eyed over a flashy new car, they often will overlook all the ways it doesn’t fit their criteria or their budget. They won’t take time to research other vehicles that might serve their needs better.

Plus, this approach is a sure way to fall on the wrong side of price negotiation.

Instead, try to maintain an even, neutral attitude. Keep a list of the pro’s and con’s of every model you consider.

3. Putting too many optional features on your “must have” list.

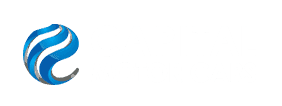

A list of “must have” features is essential. You need a car that will really work for you, that has all the functionality and features that will make your life easier.

This list will be your guidepost throughout the buying process.

Your list should be comprehensive, so you don’t end up with a vehicle that can’t get the job done. However, you must be careful not to allow too many optional features to slip onto it.

Leather seats are nice, built-in WiFi hotspots are cool and video screens for the back seats might make the kids happy, but are they necessary?

Setting your heart on a bunch of special features will make it hard to find a car that satisfies you. You’ll overlook a lot of vehicles that could suit your needs perfectly well.

If you have trouble drawing the line between “must have” and “really want,” I recommend dividing your features list into three sections:

- Must have (actual essentials)

- Should have (features you really want but can live without)

- Could have (features you would like but definitely don’t need, just to look out for)

- This hopefully will give you some more clarity and flexibility.

4. Skipping the research

The initial steps of buying or leasing a car can and should be done from the comfort of your own home.

Before you set foot in a dealership, do some basic research. Check out what vehicles fit your profile and get some quotes. By the time you talk to a dealer, you should have narrowed down your options to a few models, settled your list of features and have a sense of what you can expect to pay.

Skipping your homework makes it easy for unscrupulous salespeople to pressure you into buying a car you don’t want or paying more than you need to.

If you’re not sure where to begin, Capital Motor Cars’ advanced and easy to use search tool can help you explore different makes and models that fit your criteria and start collecting quotes.

5. Not knowing what rebates you qualify for

On a related note, a little research can show you some unexpected ways to save money.

Rebates or incentives are both terms for discounts offered to car customers who meet certain criteria. These are usually given either as a discount on the down payment or as reduced APR financing rates. They’re intended to bring in new customers, get current customers to return or to move vehicles that are selling slowly.

There are many types of rebates floating around out there. A few common ones:

- Loyalty programs: Some automakers offer discounts to customers who have already bought or leased one of their cars, to encourage brand loyalty.

- Conquest cash: On the flip side of loyalty programs, some car companies will give discounts to people who have previously owned or leased certain vehicles from competing brands.

- Student rebates: Many automakers offer discounts to help recent college grads lease or buy a car. To qualify for this, you will have to show proof of graduation within the last two years or next six months, plus proof of employment.

- Veteran Incentives: If you are a current or former member of the military, you may be able to get a few hundred dollars’ rebate from some car companies.

- Vehicle rebates or bonus cash: Some specific vehicles have rebates attached to them, usually as a limited-time offer. This is to promote new models or models which aren’t selling well. Which vehicles have rebates changes all the time, so check a recent list or ask your dealership when you’re ready to start shopping.

- Corporate incentives: Some large companies have arrangements with automakers to get better deals on cars for their employees. If you work for a company that does this, you can get significant discounts and avoid some negotiating hassle. Check with your HR department to see if something like this is available to you.

So how do you find these deals? Of course, a dealer can help but you can start on your own, by researching cars or brands that you’re interested in and seeing what incentives they offer.

6. Hurrying into a purchase

Take your time with car shopping. Rushing into a purchase or lease agreement is a sure way to end up with buyer’s remorse.

Always consider the alternatives and don’t agree to anything on the spot, no matter how much pressure a pushy salesperson might lay on you. Your own research and online reviews are your best friends.

Most importantly, don’t skip the test drive! It’s very common for a car to sound great on paper, and look amazing in the glossy sales brochure, but when you get behind you wheel you find it just doesn’t feel right.

Maybe the visibility is off, it drives rough or the seats just aren’t comfortable.

It’s impossible to know these things until you try the car out for yourself.

7. Going beyond your budget

Don’t let a salesperson convince you to go above your budget. Yes, they will make it sound like for just a few hundred (or thousand) dollars more than you were planning to spend, you will get the car of your dreams… while if you stick to your plan, all you can get is junk on wheels.

It’s just not true. Honestly, there are great cars out there for every budget.

If you decide from the beginning on the maximum price you can afford, stick to that decision. Be very firm and clear with the salespeople. Don’t look at cars you can’t afford, not even “just to get an idea of what’s out there.”

It sounds so easy before you start shopping, and feels so hard when you’re in the thick of it. So make it simple again: remember you can afford exactly what you can afford, and if you draw a firm line you’re sure to find something great within your budget.

8. Not understanding the price advertised by the dealership

Let’s face it, car prices can seem like a moving target. It’s often quite difficult for the average person to understand exactly how much a car is actually selling for, and dealers’ advertisements do little to help!

First off the bat, you have to recognize that any advertised price does not include taxes and fees that have to be paid upfront. So the actual amount you have to pay to drive off with the car may be several hundreds or even thousands of dollars more than the number splashed on the ad.

There’s no getting around all of these extra charges, but there’s nothing that isn’t up for negotiation. Come prepared to read the fine print and push for a better deal on everything, especially the car’s price.

As for the price itself, even this can be hard to pin down.

When you see an advertisement or go to a dealership, the price that they’ll quote you for the car is what’s known as the sticker price or MSRP (“manufacturer’s suggested retail price”). This is the price that the dealer would like for you to pay. Although it’s usually presented in a way that looks very official, in reality it’s only a starting point for negotiation and savvy customers will pay significantly less.

And it’s not the only starting point: look up the invoice price (the price that dealers are paying for that car) or a market value price (what most customers are paying for the car in question, which can be found on a site like Edmunds or Kelley Blue Book. This will give you solid ground to negotiate a fair price.

Bonus Mistakes

Making Errors in negotiation

Many car customers focus only on the monthly payment, and salespeople often encourage this. The first question you hear in a negotiation is often something like, “How much are you thinking of paying every month?”

When you only look at the monthly payment as a lump sum, it’s hard to tell if you’re getting a fair deal on each element of the price. You may also end up paying more in interest if you get hooked into a lengthy loan period. (This is a trick known as “interest-rate bumping.”)

First settle on the price of the vehicle itself. Then insist on negotiating one thing at a time: trade-in value, financing or leasing terms, etc.

By the way, if you qualify for incentives that bump down the car’s price, you can still negotiate for further savings! Just take the reduced price as a starting point and go from there.

Not working with an expert

Buying or leasing a car can seem like a complicated, overwhelming process.

To be honest, it can be. As a customer, you probably only buy a car every few years at most, making it even harder to stay on top of everything involved.

That’s why it’s a good idea for most people to have an expert on their side. This might be a professional auto broker, someone whose job it is to find the best deals and take care of the messy business, or simply a professional service like Capital Motor Cars, where we use our experience in the field and sophisticated car-finding software to help clients locate their perfect car at the best price.

Turning mistakes into the right move

In general, try to come into car shopping and negotiating with the right attitude and mindset for success.

- Instead of being impulsive, be systematic. Emotions and good decisions don’t always go hand in hand, especially when it comes to car shopping. Be patient and consider all possibilities rationally, with a careful eye over the numbers.

- Instead of being too trusting, be canny. Trust yourself, trust your partner, trust your kids… but don’t trust the sleazy salesperson! No matter how nice they seem, remember their interest is to get you to pay as much as possible for a car they want to move off the lot. Your interest is paying as little as you can for the right car.

Instead of being afraid of losing out, be confident you can find better. The oldest trick in the sales team’s book is to make you feel as if there’s a once-in-a-lifetime offer on the table, and if you pass it up you’ll never find a decent price on a good car again. It’s just a sales trick. Remembering there are always other options takes the pressure off you in negotiations, and the less pressure you feel the better you can make the right decisions.

Conclusion

Success in car shopping boils down to three critical points: doing your own research, being clear with yourself about your needs, and being firm about what you want with salespeople.

Clarity is always the best policy!

Always remember it’s in your power to step away from a deal at any point, right up until you sign the contract. If it doesn’t feel good to you, chances are it isn’t. Just keep searching, a better deal may be right around the corner.