When you’re looking for the best deal on a car lease, nothing can get your attention as fast as… well, nothing.

Jump To Section

If you’ve spent any time whatsoever shopping for a car, you’ve probably stumbled across lease deals advertised as zero money down, zero down payment or just plain zero down. It definitely sounds too good to be true, but is it really?

In fact, zero-down leases are legitimate deals offered by many companies, including Capital Motor Cars. They aren’t money-saving magic tricks, but for leasers who qualify, they can make it easier to finance a lease.

To understand what “zero-down” actually means, you’ll have to understand how lease payments work. This knowledge will help you find and negotiate the best lease deal on the car you want.

What do you actually pay for in a lease?

Negotiating a car lease is complicated and can be very confusing, especially because most people don’t understand the terminology and calculations that determine what they’re going to pay. This makes it easy for customers to get lost and taken advantage of while negotiating.

As a customer, you should know what’s going into your lease contract.

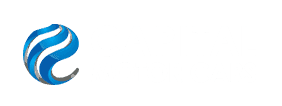

The total cost of the lease – what your down payment and monthly payments will cover over the lease period – is known as the capitalized cost or cap cost. This includes:

- Depreciation: The bulk of your monthly payments are covering the depreciation of the car, or its loss in value over time. This is based on the residual value of the vehicle, what it’s predicted to be worth at the end of the lease period. For example, if a car is worth $30,000 but in three years it will likely only sell for $20,000, your monthly payments will have to cover the difference ($10,000) over three years.

- Fees: Bank fees, DMV fees, and documentation fees will all factor into your bills, either upfront or as an addition to your monthly payment. (The second option is known as a “sign and drive” deal.)

- Interest: The interest rate, often called the lease factor or money factor is based on your credit score. It varies between leasing companies, but expect anywhere from 2-5% for strong credit to 10-15% for poor credit.

- Taxes: In most states, you will pay taxes only on your monthly payments, not the value of the car. This helps make leasing more affordable than buying. However, you might also have to pay taxes on whatever you pay upfront.

- Down payment: Finally, some lease contracts will ask for a certain amount of money upfront: a down payment or cap cost reduction. This payment goes towards what you will have to pay every month during the contract.

The down payment – what we’re most concerned with here – is usually 10-20% of the value of the car. If you qualify for any rebates, these will be subtracted from the down payment.

What “zero-down” really means

A zero-down lease offer means simply that there is no down payment.

However, it doesn’t mean that you can show up without a penny. The down payment is only one part of what you pay for in a car lease, as we’ve just seen. With a zero-down lease, you will still have to pay something out of pocket. This typically includes:

- First month’s payment

- Taxes

- License and registration fees

- Document fees

In certain cases, you can negotiate for these “drive-off fees” to be rolled into the monthly payments or even covered by rebates. Then you really would get to drive away for $0!

However, remember that these fees don’t just disappear. You’ll simply cover them over time with higher monthly payments, instead of one big chunk of cash upfront.

Should I look for a zero-down lease deal?

“No money down” sounds great, but is there a catch? Do these deals really save you any money or trouble?

It’s true, they’re not without their drawbacks, the most significant of which might be that not everyone can qualify for them.

But overall, if they’re an option for you, zero-down leases can be a great way to slide more easily into a car lease, if you know what you’re getting into and how to negotiate a good deal.

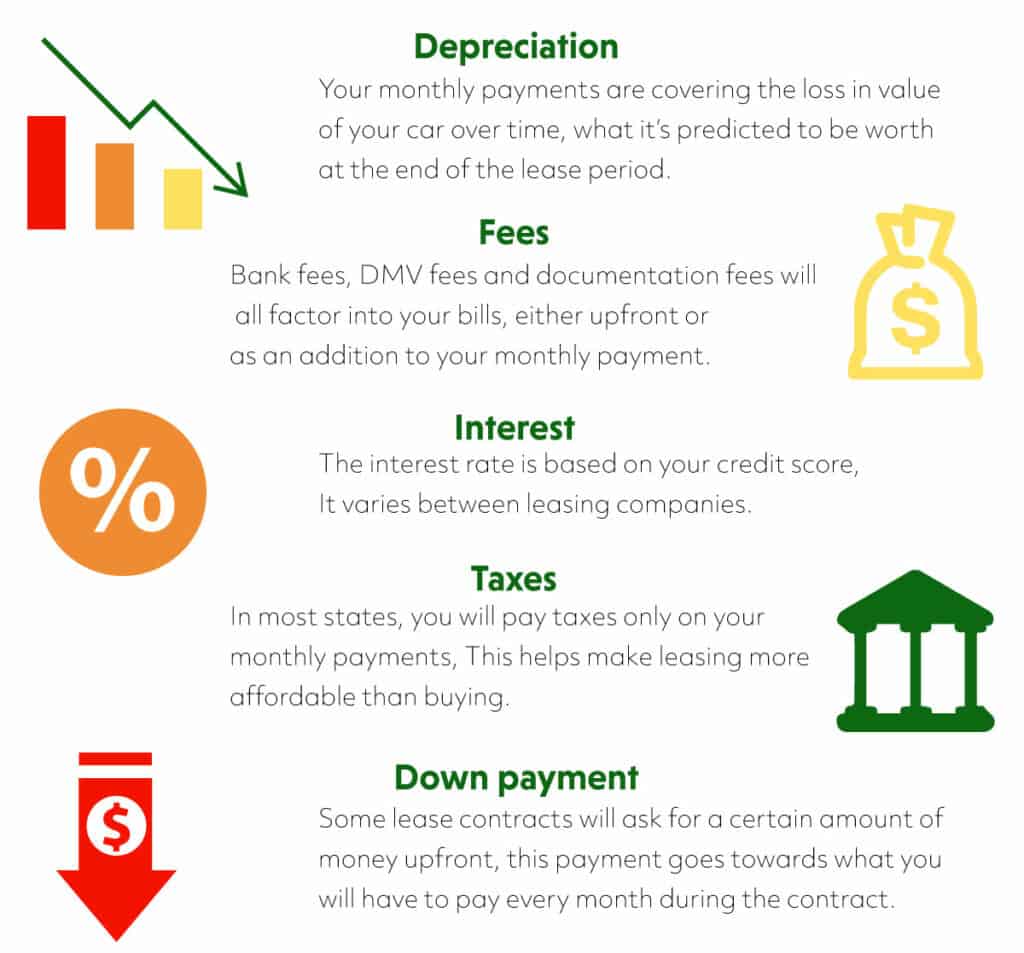

Benefits of a zero-down lease

There are a few appealing sides to a zero-down lease deal.

-

Less money paid upfront

First of all, the obvious reason why zero-down offers attract so much attention.

With no down payment, you’ll have to pay much less up front. This could mean the difference between having to borrow a big of chunk money to start your lease and just filing monthly payments as you go.

This makes starting a lease much simpler and easier.

-

Pay taxes slower

With no down payment, you’ll also pay taxes at a much slower rate. You’ll be taxed a small amount on each monthly payment, instead of adding a bigger tax payment to your upfront expenses.

Of course, over time the taxes will add up to the same, just as you’ll eventually pay the down payment within your monthly payments. What it does is make the tax payments more manageable.

-

Less at risk in case of an accident

Finally, you’re at less financial risk in case of an accident.

The leasing company holds the title to the vehicle, so any insurance payments go to them if you total the car or it gets stolen. This would also spell the end of the lease contract, meaning your down payment is lost forever, even if the accident is on your way home from the dealership.

With a zero-down contract, if the car is totaled then essentially you only lose the registration and documentation fees. You can start again with a clean slate.

Drawbacks of zero-down

This said, zero-down deals have their drawbacks. Otherwise, why would anyone ever choose a deal with a down payment?

There are three main downsides to skipping the down payment:

-

Higher monthly payments

Think of thelease arrangement as a balanced scale: what you pay upfront on one side, the payments over the course of the lease period on the other. When you reduce the weight on one side, the other side goes down. You’ll have to make up for the difference one way or another.

Remember that the down payment is also known as a cap cost reduction. It usually would offset the total cap cost that your payments are covering every month. So if there’s no down payment, you’ll end up paying more every month.

For example, consider a lease offer at $250 per month over 36 months with $2,000 down. If you take the same car as a zero-down lease, that $2,000 will be rolled into your monthly payments. That means an extra $55.50 per month ($2,000 divided by 36), so you’ll be looking at a little over $300 per month before interest and taxes.

It still might be easier for you to handle than a hefty down payment, but higher monthly payments also mean higher interest and taxes. Taxes over the lease period might add up to more than if you had given the down payment.

-

Higher interest payments

Part of your monthly payments is interest (or “money factor” in industry terms). If your monthly payment rate goes up, so does the interest. Raise the monthly payment enough and over a few years, you may end up paying substantially more than you would have if you gave a down payment.

Of course, whether or not it’s worth it depends a lot on your rate of interest, which in turn depends on your credit. You have to do the calculations yourself.

-

Hard to qualify for

Zero-down deals can also be hard to actually get approved for. They’re usually only offered to customers with “Tier 1” credit scores, the highest level.

In this way, zero-down lease offers are often used as a marketing ploy. They’re an easy way to get people through the door, but then often not available to the customers who have already become interested in the car.

However, even if you don’t have Tier 1 credit, there’s still a chance for you to get into a zero-down deal. You need a co-signer, someone with good enough credit to qualify for the lease. This person will be part of your lease as a sort of financial back-up, so if you ever can’t make your monthly payments, they are responsible to cover them.

Working with a co-signer is a serious commitment on both sides. Therefore this person has to be really capable of fulfilling the agreement if necessary and someone with whom you have mutual trust.

Weighing the pro’s and con’s

So the question remains… should I look for a zero-down lease offer?

I’d say yes if:

- You have top-level credit

- You understand the nitty-gritty side of lease contracts

- You’re good with numbers

- You aren’t an impulse signer

- You are confident in negotiation, recognizing your own best interests and standing up for them

If your credit isn’t so good, you’re liable to find yourself pushed around by salespeople or all this lease terminology goes in one ear and out the other, it’s probably better not to bother with zero-down deals.

Always negotiate and read the fine print

When you see a flashy advertisement from a dealership promising a too-good-to-be-true zero-down deal, check that it isn’t really too good to be true. As I’ve explained earlier, the actual amount due at signing is considerably more than just the down payment and first monthly installment.

Taxes, registration and acquisition fees can bring the amount due to much higher than the enticingly low figure on the ad. When you come into the office, the first thing to clarify is what the offer in question actually means. You need to know where you stand before you can start negotiating.

On this note, remember that negotiation isn’t only for buying a car. You can negotiate every aspect of a lease contract, especially the price of the car, which is the single biggest component in determining monthly payments.

If you know you have very good credit and you find a car you want with a substantial down payment, you can even ask for a zero-down option. Just be sure you understand all the elements of a lease and you’re confident in negotiating so the deal comes out in your favor.

Finally, be sure to run the numbers on any lease offer but especially on a zero-down deal. The down payment should be rolled flat into the monthly payments, but some dealerships will tack on a little extra for themselves, hoping starry-eyed customers won’t notice.

If the payments over the lease contract don’t stack up against the cap cost as you understand it, keep shopping.

Conclusion

A promise of $0 is hard to ignore.

The good news is that these offers are really out there and they can take a lot of the pressure out of signing a lease.

The bad news is that you might not qualify for one, and if you do, you’ll get higher monthly payments.

However, that might not be such a price to pay to avoid taking out a loan or whatever you have to do to finance a few thousand dollars upfront.

At Capital Motor Cars, we offer many zero-down leases on popular cars and SUV’s. We find that these deals make it easier for many our clients to Get Started on their lease. Contact us and we’ll work with you to help formulate the best deal for your budget.